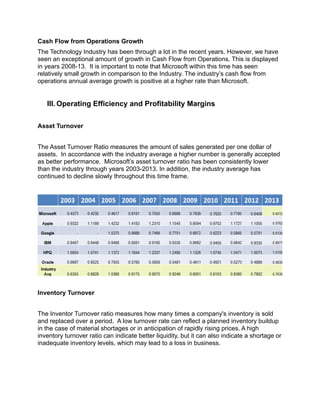

operating cash flow ratio industry average

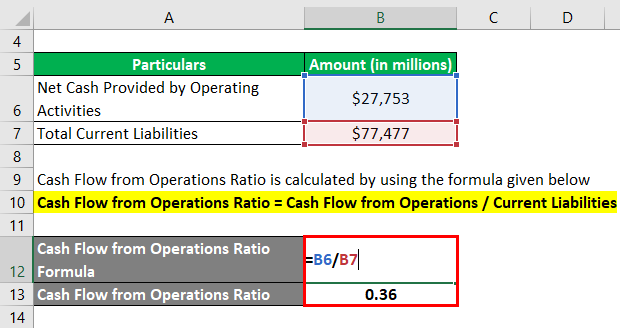

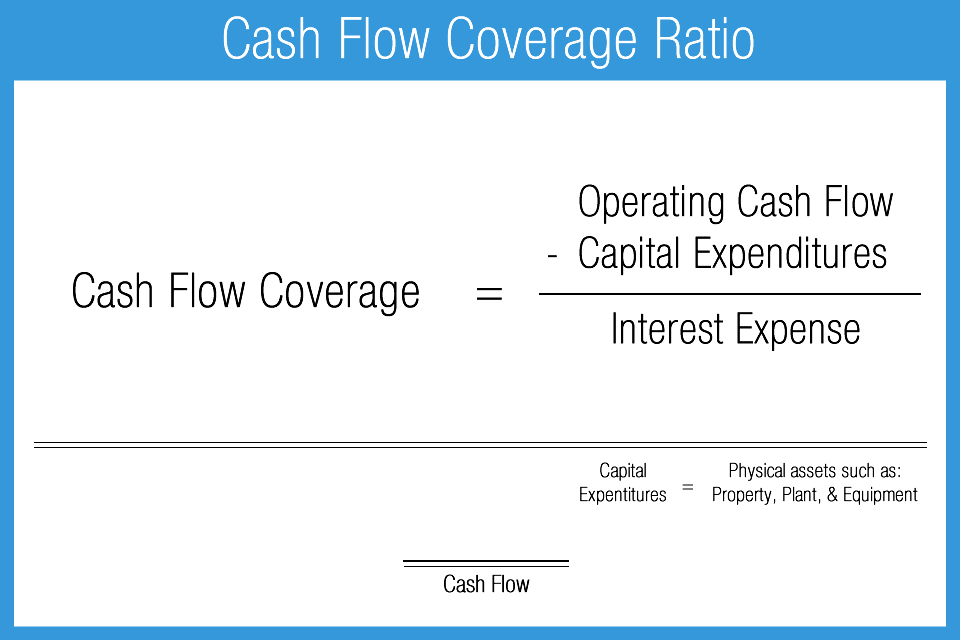

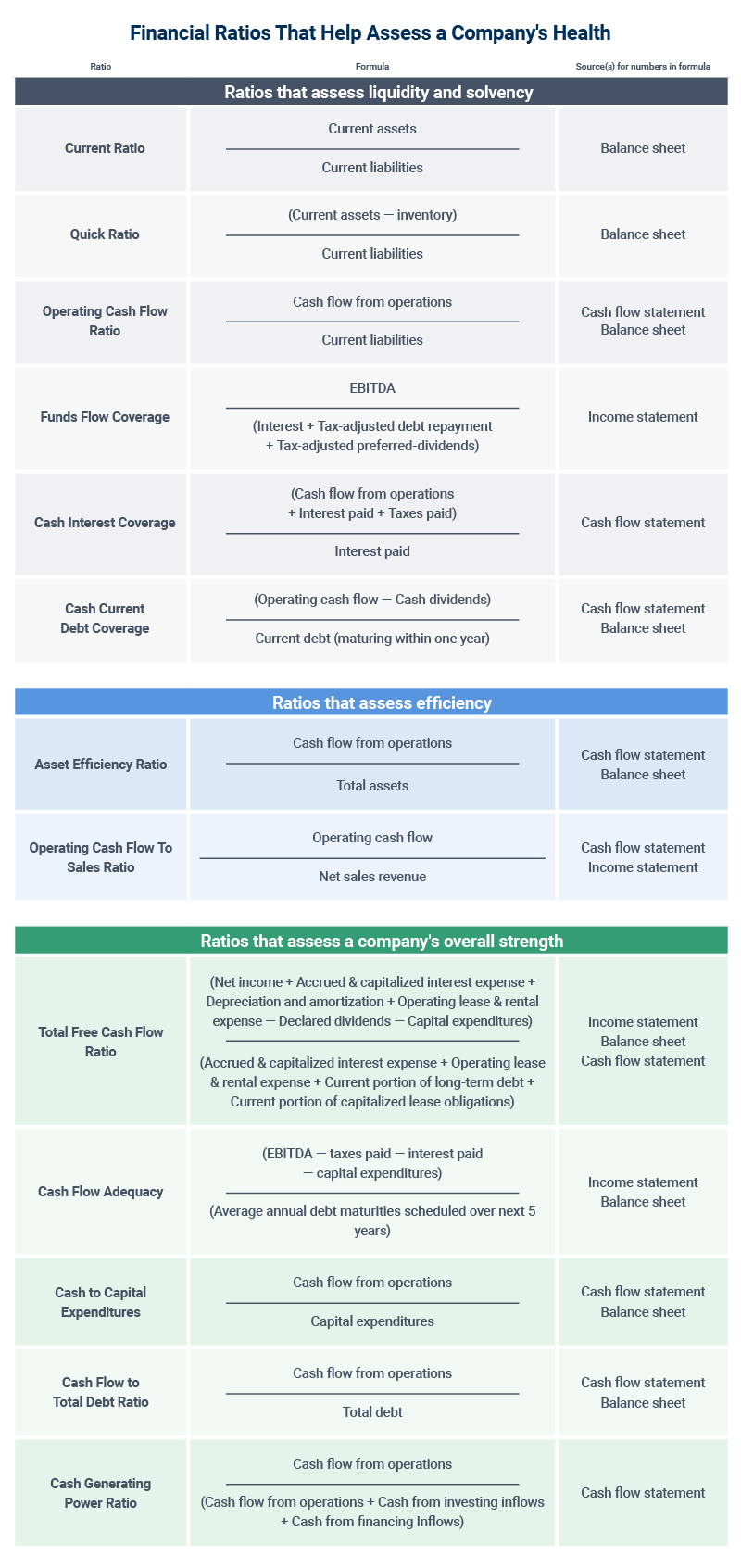

Each ratio reveals a specific financial aspect of the company. We can apply the values to our variables and calculate the cash flow coverage ratio using the formula.

What Is Operating Cash Flow Ratio Guide With Examples

Instead we use the.

. They use some ratios more frequently used than others depending on the business and its financial needs. Price Earnings Price Book Net Profit Margin Price to Free Cash Flow Return on Equity Total Debt Equity and Dividend Yield. However we do not use the most liquid money and assets currently held by the company.

Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance. The formula to calculate the ratio is as follows. In this case the.

Operating Cash Flow. Operating cash flow ratio industry average Sunday July 24 2022 Edit. This ratio is similar to the cash ratio.

Yahoos Industry Statistics ratios include. Ten years of annual and quarterly financial ratios and margins for analysis of Restaurant Brands QSR. 75 rows Cash Ratio - breakdown by industry.

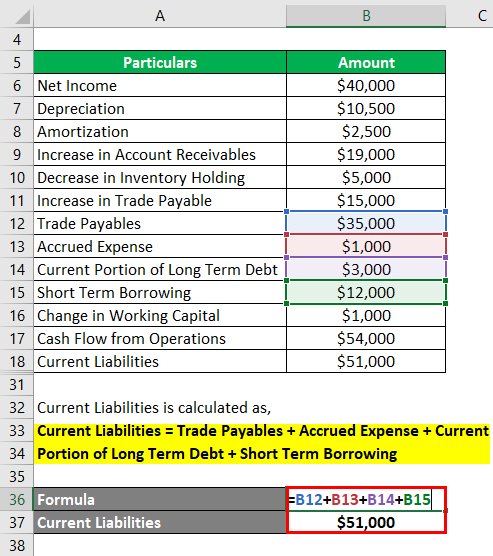

Put simply its a. Quick ratio Cash ratio Operating cash flow ratio Industry Average Industry 2019-20 2020-21 2021-22 Average Revenue 49 45 37 4366666667 Employment 3 19 23 24 Wages. Therefore cash is just as important as sales and profits.

Cash ratio is a refinement of quick ratio and. The operating cash flow ratio is a measure of how readily current liabilities are coveUsing cash flow as opposed to net income is considered a cleaner or more accThe operating cash flow ratio indicates if a companys normal operations are sufficiA higher ratio means that a company has generated more cash in a peri See more. Free Cash Flow growth Comment.

Operating cash flow margin is a profitability ratio that measures your businesss cash from operating activities as a percentage of your sales revenue over a given period. This ratio indicates the ability of a company to translate its sales into cash. Many financial analysts place more.

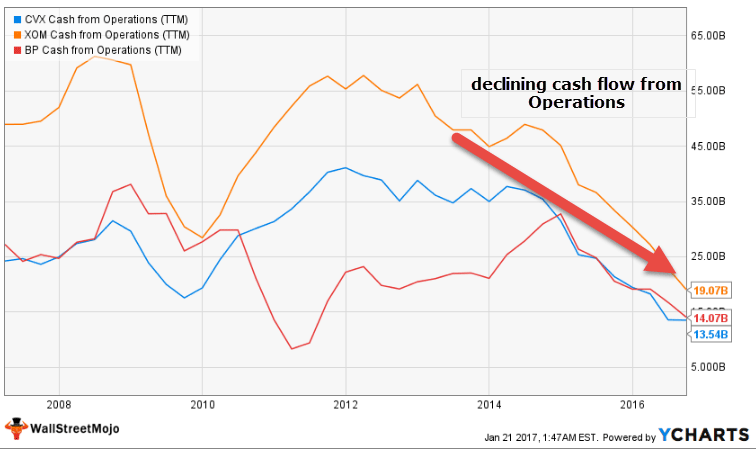

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. Calculation formula The formula for this ratio is. Major Pharmaceutical Preparations Industry s pace of Free Cash Flow growth in 3 Q 2022 accelerated to 545 year on year above Industry average.

Liquidity Ratio Formula And Calculation Examples Cash Flow Per Share Formula Example How To. On the trailing twelve months basis Oil And Gas Production Industry s ebitda grew by 5034 in 2 Q 2022 sequentially faster than total debt this led to. Debt Coverage Ratio Comment.

Operating cash flow ratio. Cash flow per share is the after-tax earnings plus depreciation on a per-share basis that functions as a measure of a firms financial strength.

/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

Cash Flow Statement What It Is And Examples

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Financial Ratios Complete List And Guide To All Financial Ratios

Pdf End Term Suggested Answers And Common Mistakes Udit Bansal Academia Edu

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow To Sales Ratio Formula Example Analysis Planergy Software

What Is Operating Cash Flow Ratio Guide With Examples

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow Ratios Accounting Play

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Operating Cash Flow Basics Smartsheet

Solved Compute And Interpret Cash Flow Ratios Use The Chegg Com

Solved Net Cash Provided By Operating Activities Information Chegg Com

5 Important Ratios For Effective Cash Flow Analysis Elm

:max_bytes(150000):strip_icc()/cashflow_final-c3af6d2c837542149167b21b3f664681.png)

Cash Flow What It Is How It Works And How To Analyze It

Solved Income Statement Sales Revenue Cost Of Sales Gross Chegg Com